Checklist before investing in a publicly listed stock

Important questions to consider before making an investment

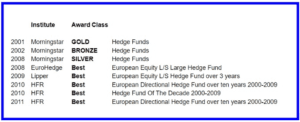

You don’t win hedge fund awards by going after tenbaggers

Avoiding losers is more important than finding winners

Pause and think objectively to answer the following questions:

- What is the expected return and time horizon for the investment? Are there better alternatives?

- Why did you choose this company? Was it the first time you laid eyes on it? Did it fall into your lap, or did you carefully single it out in competition with many other options?

- Do you understand how the value is created (production, distribution, customer benefit) and how to get a share of it?

- Do you understand the company’s raison d’être, its rational place in the economy? What role does it fulfill in the world?

- Does the company need to succeed in something new and extreme (e.g., FDA approval, developing technologies in the R & D stage) in order to turn a profit?

- Does the world have to change for you to be right? Then maybe it’s wishful thinking. “Status quo” is usually the best assumption.

- Ask yourself what will not, or is likely to change in the next 5-10 years, and what you can confidently forecast & base your decisions on: products, technology, processes, interest groups, macro factors.

- Are you early or late to the investment idea? How much is reasonably left on the table for you in the investment case?

- Do you understand the criticism, the sellers’ narrative? Do you know why the sellers don’t want to own it?

- What is the biggest weakness in your forecasts and analysis? What is the most uncertain factor? What if something goes wrong?

- Could it be a Ponzi scheme? Do you understand how the value is created and extracted?

- Should you really buy today, or is the market or share price temporarily overbought from a technical analysis perspective?

- Is the downside acceptable if the worst happens? Can you afford bad luck and still make a profit??

- Do you have to be lucky or find an irrational buyer to make a profit?

- Is it reasonable to assume that the company will be able to weather tough regulations, increased taxes or competition?

- Would you recommend the investment to a good friend?

- Does the investment fit into your portfolio strategy? Would an intelligent investment peer be surprised if they saw the position in your portfolio?

- Have you created a timeline of milestones in order to anticipate and understand the reasons for potential surprises?

- Do you have a plan B in case things don’t go as planned? Stop loss procedure? When and why would you change your view?

- Do you feel FOMO, experience urgency or strong emotions (greed for example)? You should never buy when emotional or stressed.

You May Also Want to Read: